|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

1 Top AI Stock That’s on Wall Street’s Radar/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Ambarella (AMBA) is gaining traction as one of Wall Street’s top AI opportunities. Its second quarter of fiscal 2026 earnings highlighted a clear leadership position in edge AI, a fast-growing segment of artificial intelligence. This is probably why Wall Street has taken note. With five consecutive quarters of record edge AI sales, increased demand in various new areas, and a stronger financial outlook, Ambarella is positioning itself as a top AI stock to watch. Valued at $3.4 billion, AMBA stock has gained just 9.4% year-to-date, but Wall Street believes there is more room to run.

Investing Heavily in Edge AIAmbarella is a semiconductor company that focuses on low-power, high-performance semiconductors, particularly system-on-chips (SoCs). These are used to carry out AI and computer vision tasks directly on devices. In the second quarter, Ambarella reported revenue of $95.5 million, up 11% sequentially and above the company’s prior guidance range of $86 million to $94 million. Revenue also increased by an amazing 49.9% over the second quarter of fiscal 2025. It also marked the company’s fifth consecutive quarter of record edge AI revenue. The company also announced an adjusted net profit of $0.15 per diluted share, up from a net loss of $0.13 in the same quarter last year. Ambarella ended the quarter with $261.2 million in cash, cash equivalents and marketable debt securities, with free cash flow came of $1.4 million. Ambarella’s success is the result of years of consistent investment in cutting-edge AI research and development. Since joining the edge AI industry over five years ago, Ambarella has delivered over 36 million processors to hundreds of customers. The company’s portfolio of 5-nanometer AI SoCs has enabled it to enter a broader range of markets. Initially focused on enterprise security cameras, Ambarella’s edge AI revenue has since grown to include smart home devices, automobile safety, and telematics. The company is now pursuing three new markets, boosting its growth:

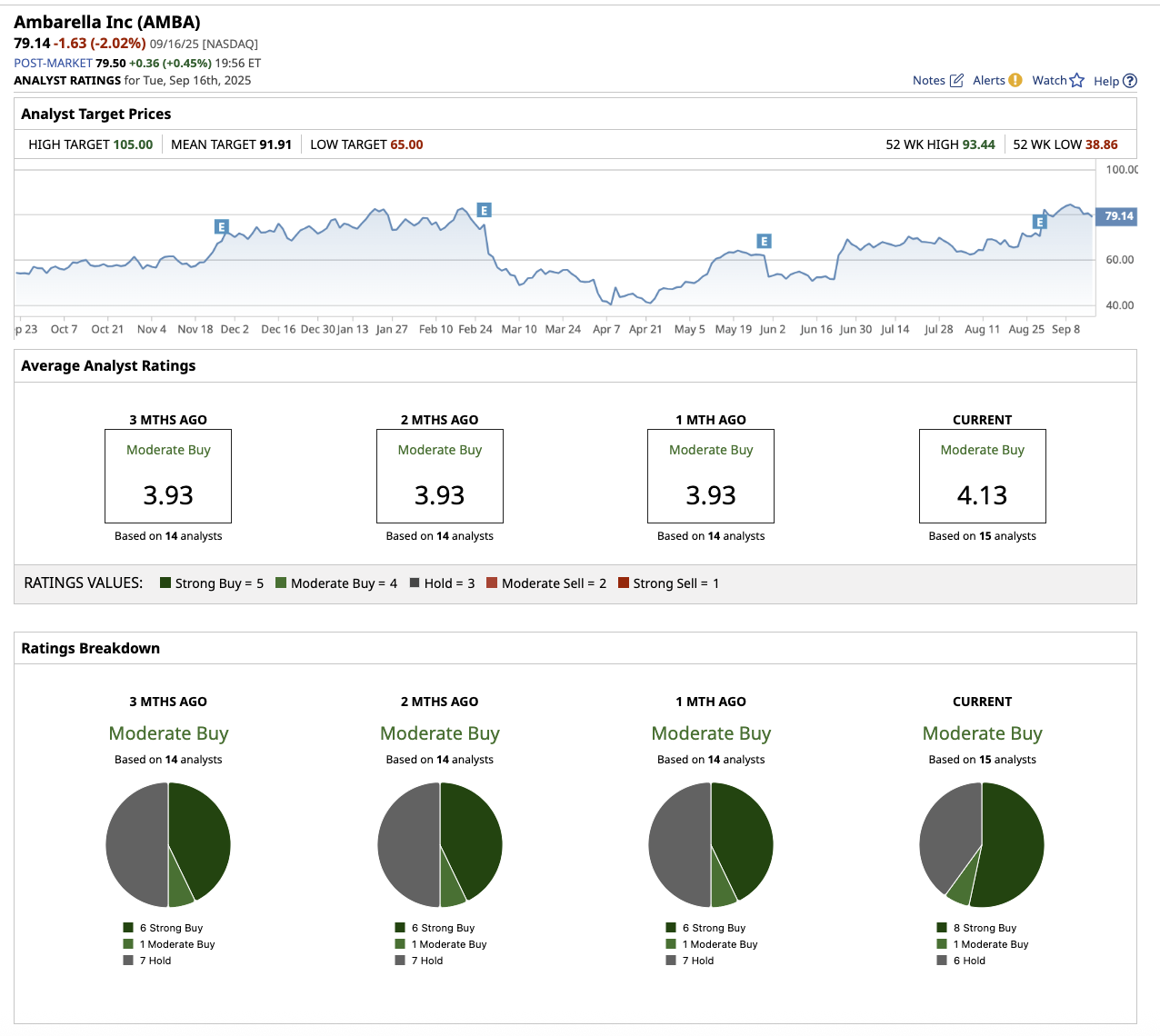

Management expects edge AI to account for approximately 80% of Ambarella’s overall revenue in fiscal 2026. For the full fiscal year 2026, Ambarella forecasts 31% to 35% revenue growth, significantly higher than its earlier estimate of 19% to 25%. The change in revenue projection indicates that demand across its product portfolio is increasing faster than management had anticipated. Analysts’ projections for fiscal 2026 align with management’s estimates, while expecting revenue to increase by 7.4% in fiscal 2027. Furthermore, Ambarella is focusing on some of the most interesting AI prospects, such as autonomous robots, AI-powered video, next-generation automotive safety, and edge computing infrastructure. Each of these markets is likely to grow significantly over the next decade, indicating that Ambarella is entering a new growth period that investors don’t want to overlook. What Does Wall Street Say About Ambarella Stock?With solid Q2 earnings, an updated full-year revenue projection, substantial cash reserves, and clear leadership in a high-growth AI segment, Ambarella is earning a spot on Wall Street’s radar. Notably, Exane BNP Paribas, Summit Insights Group, and Rosenblatt Securities, all maintained their “Buy” ratings on the stock. Morgan Stanley analyst Joseph Moore reiterated his “Buy” rating for Ambarella, highlighting the company’s solid performance and intriguing growth forecast. Moore emphasized Ambarella’s successful diversification beyond traditional security markets, noting growth in portable video, drones, and other non-security applications. With a strong order book and minimal inventory worries, he believes Ambarella is well-positioned for future growth. Overall, Ambarella stock is rated as a “Moderate Buy” on Wall Street. Out of the 15 analysts covering the stock, eight rate it a “Strong Buy,” one says it is a “Moderate Buy,” and six recommend a “Hold.” The average target price of $91.91 suggests the stock can rally by 16.1% from current levels. Plus, its high price estimate of $105 indicates the stock could gain 32.6% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|