|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

Why Investors Are Excited About Palantir Stock Again/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

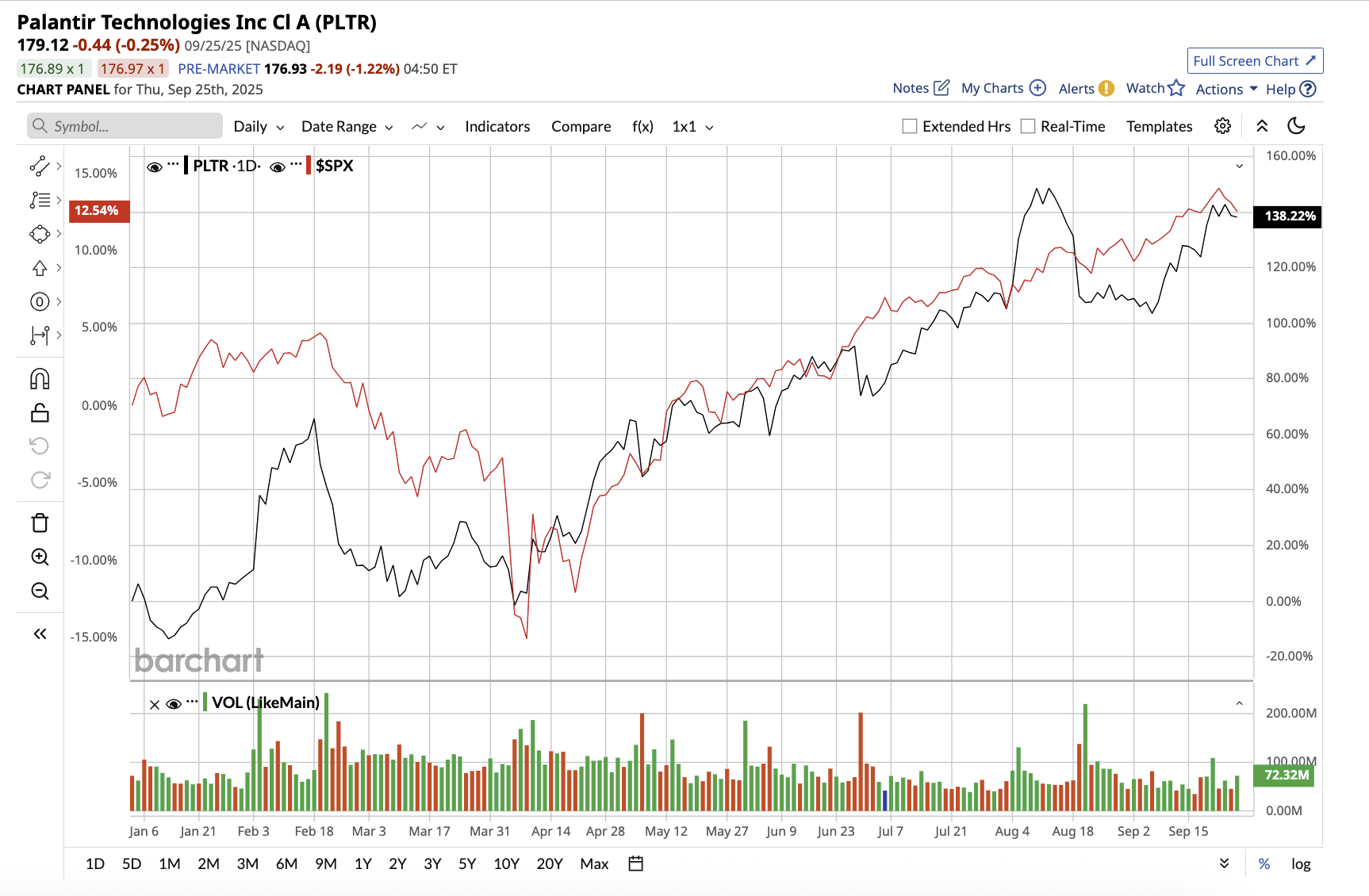

Palantir Technologies (PLTR) has quickly progressed from a backstage player to one of the most talked-about artificial intelligence (AI) winners in the market. Investors are excited about its major government contract wins, booming commercial usage, a new AI product stack, and a succession of high-profile partnerships. PLTR stock has climbed an impressive 138.2% year-to-date (YTD), and its strong second-quarter results explain why investors are taking a fresh look at the company.

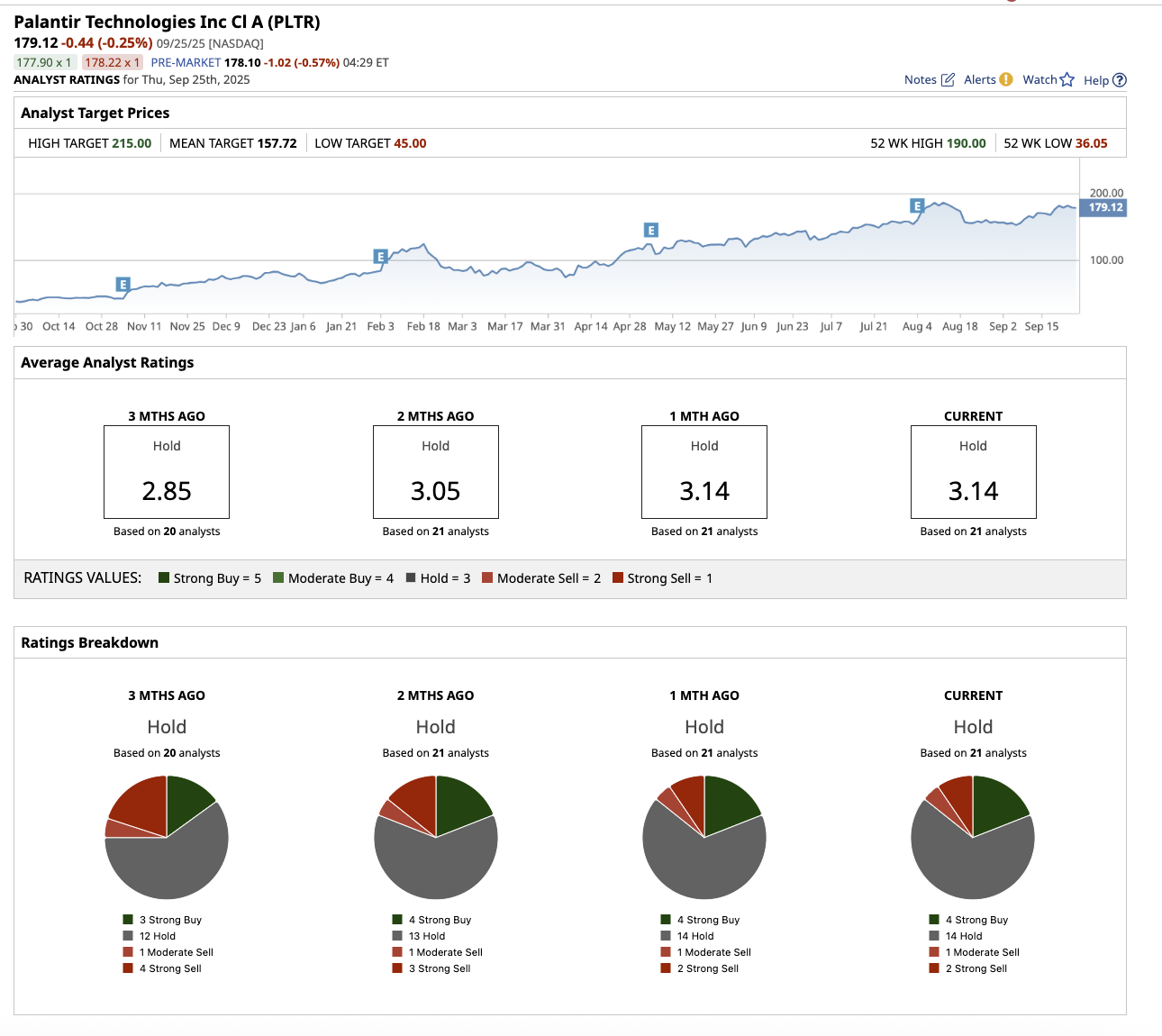

Valued at $424.7 billion, Palantir is a software company that specializes in big data analytics, artificial intelligence (AI), and decision-making platforms. Its tools, Gotham, Foundry, and the Artificial Intelligence Platform (AIP), integrate massive amounts of data from different sources, analyze it, and use it for insights and operational decisions. In the second quarter, the software and AI leader not only surpassed the billion-dollar revenue threshold for the first time but also showed accelerating momentum in both commercial and government markets. Palantir's U.S. business remains the driving force behind its success. Overall U.S. revenue increased 68% year-on-year (YoY) and 17% sequentially, accounting for 73% of overall revenue. U.S. Commercial was the standout performer, climbing 93% YoY and 20% sequentially. That segment now contributes 31% of company revenue, up from 23% a year ago, underscoring how quickly private-sector adoption is ramping up. Meanwhile, U.S. Government revenue also impressed with 53% YoY growth and 14% sequential growth. Together, these trends helped lift Palantir’s total revenue by 48% YoY in Q2, far outpacing prior guidance. Palantir’s profitability expanded along with its top line. Adjusted earnings per share (EPS) stood at $0.16. The company's Rule of 40 score jumped to 94, marking the ninth consecutive quarter of progress, a rare thing in enterprise software. Free cash flow remained strong at $569 million, with expectations of $1.8 billion to $2 billion for the full year. Palantir also repurchased 2.5 million shares, ending the quarter with $6 billion in cash and U.S. Treasuries. Bigger Deals Could Lead to More SuccessPalantir also saw unprecedented deal activity with high-profile clients in Q2. It booked $2.3 billion in total contract value (TCV) and $684 million in annual contract value (ACV). It closed 157 deals worth at least $1 million, including 42 worth more than $10 million. Existing customers are also spending more. The company's top 20 now average $75 million in trailing 12-month revenue, a 30% increase YoY. The AIP platform is key to Palantir's current momentum. Management stated that customers are replatforming their software on AIP, citing speed to value and competitive advantage. While the commercial segment is rapidly expanding, Palantir hasn’t forgotten its roots. The company is generating robust demand from the government as well. The U.S. Army awarded Palantir a 10-year enterprise agreement worth up to $10 billion. The U.S. Space Force awarded a $218 million delivery order, while the ceiling for the Maven Smart System contract was lifted by $795 million to meet surging demand. The strong quarter prompted Palantir to raise guidance significantly. Q3 revenue is projected at $1.085 billion, representing 50% YoY growth. For the full year, Palantir now expects $4.15 billion in revenue at the midpoint, reflecting a 45% growth rate. U.S. Commercial alone is now expected to exceed $1.3 billion in revenue, growing at least 85% for the year. Importantly, Palantir continues to expect sustained GAAP profitability in every quarter of 2025. Analysts who cover Palantir expect earnings to increase by 56.7% in 2025 and 31.8% in 2026. Palantir's stock is expensive, trading at 211 times 2026 estimated earnings, but it also reflects investors’ enthusiasm about the company’s long-term growth prospects. Is PLTR Stock a Buy, Hold, or Sell on Wall Street?While investors’ excitement for PLTR stock has renewed, analysts remain cautious owing to the company’s unconventional methods and high valuation. Overall, PLTR stock is rated as a “Hold.” Among the 21 analysts that cover the stock, four rate it a “Strong Buy,” 14 say it is a “Hold,” one rates it a “Moderate Sell,” and two say it is a “Strong Sell.” PLTR stock has surpassed its average target price of $157.72. Its Street-high estimate of $215 implies the stock has upside potential of 20% from current levels. Palantir seems to have reached a true turning point after two decades of developing its software and AI backbone. Its government contracts provide a foundation of stability and scale, while accelerating commercial adoption shows how the broader AI economy is tilting in Palantir’s favor. For investors, the story is no longer about potential, which is why it is once again commanding investor excitement. Although the recent rally may tempt some shareholders to take profits, Palantir still stands out as a compelling long-term growth story worth holding onto.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|