|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

NVR Earnings Preview: What to Expect/NVR%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

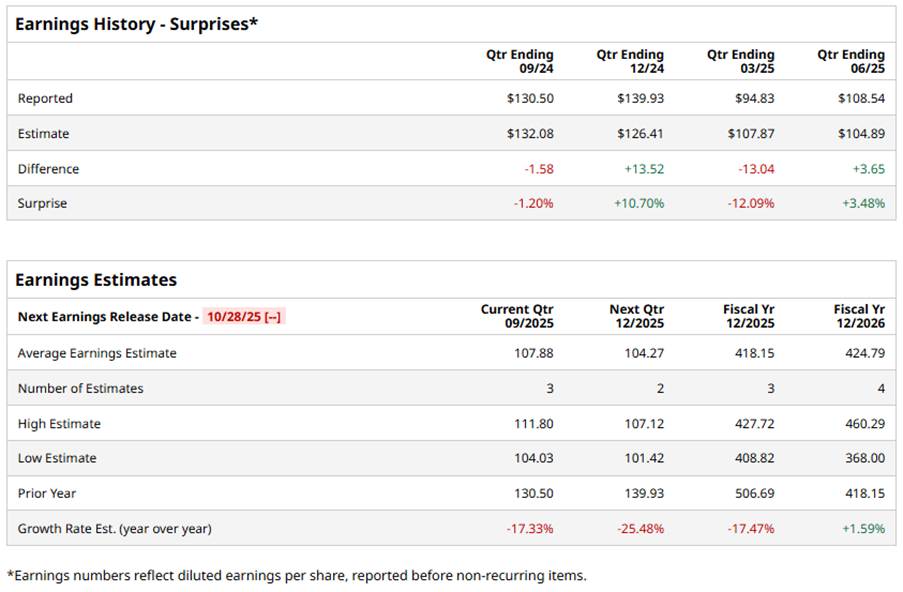

NVR, Inc. (NVR) is a leading U.S. homebuilding firm headquartered in Reston, Virginia. Operating through its Ryan Homes, NVHomes and Heartland Homes divisions, NVR primarily engages in the design, development and sale of single-family detached homes, townhomes and condominiums, and also maintains a mortgage banking arm. NVR’s market capitalization is around $21.4 billion. The company is expected to announce its fiscal third-quarter earnings for 2025 soon. Ahead of the event, analysts expect NVR to report a profit of $107.88 per share on a diluted basis, down 17.3% from $130.50 per share in the year-ago quarter. The company has missed Wall Street’s EPS estimates in two of the last four quarterly reports, while topping estimates on the other two occasions. For fiscal 2025, analysts expect NVR to report EPS of $418.15, down 17.5% from $506.69 in fiscal 2024. However, its EPS is expected to rise 1.6% year-over-year (YoY) to $424.79 in fiscal 2026.

NVR stock has underperformed the S&P 500 Index’s ($SPX) 17.4% gains over the past 52 weeks, with shares down 18.9% during this period. Similarly, it underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20% gains over the same time frame.

NVR is facing headwinds from both macro and business-specific challenges. On the macro side, elevated mortgage rates and weakening housing affordability are dampening demand for new homes, which puts downward pressure on bookings and revenues. Analysts have flagged that lot costs and pricing pressure are squeezing NVR’s margins. Moreover, in recent quarters, NVR saw declines in new orders, rising cancellation rates, and a shrinking backlog as consumers became more cautious. Analysts’ consensus opinion on NVR signals caution, with the stock having a “Hold” rating overall. Out of seven analysts covering the stock, one advises a “Strong Buy” rating, five give a “Hold,” and one recommends a “Strong Sell.” NVR’s average analyst price target is $8,350, indicating a potential upside of 7.6% from the current levels. On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|