|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

Here's What to Expect From Equity Residential's Next Earnings Report

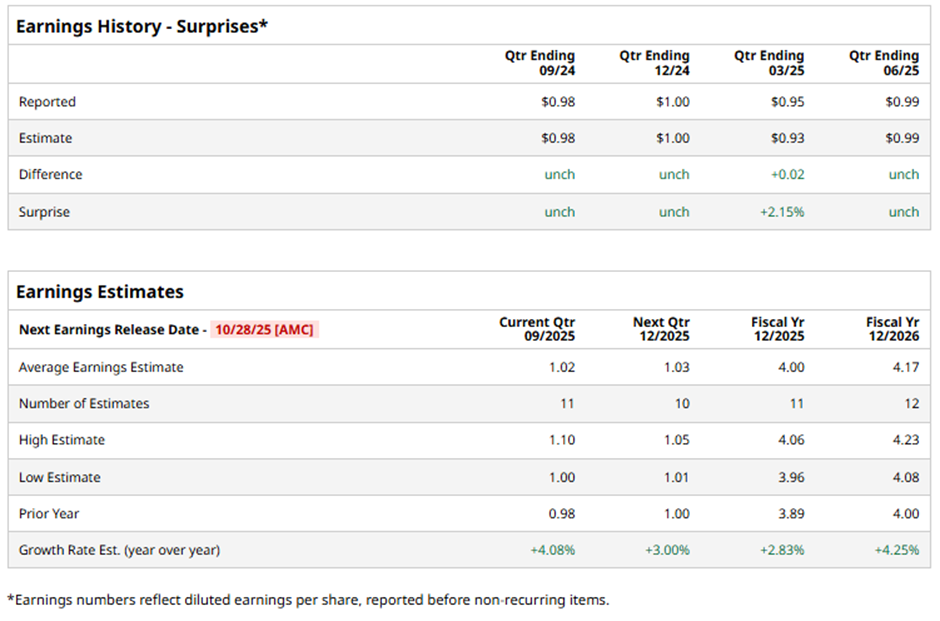

With a market cap of $23.7 billion, Equity Residential (EQR) is a leading real estate company that owns, develops, and manages high-quality apartment communities across major U.S. cities. It operates 317 properties with 85,936 units, expanding from coastal markets into Denver, Atlanta, Dallas/Ft. Worth, and Austin. EQR is expected to release its fiscal Q3 2025 earnings results after the market closes on Tuesday, Oct. 28. Ahead of this event, analysts project the Chicago, Illinois-based company to report a normalized FFO of $1.02 per share, a growth of 4.1% from $0.98 per share in the year-ago quarter. It has met or surpassed Wall Street's bottom-line estimates in the last four quarterly reports. For fiscal 2025, analysts forecast the REIT to report an NFFO of $4 per share, up 2.8% from $3.89 per share in fiscal 2024. Moreover, NFFO is expected to grow 4.3% year-over-year to $4.17 per share in fiscal 2026.

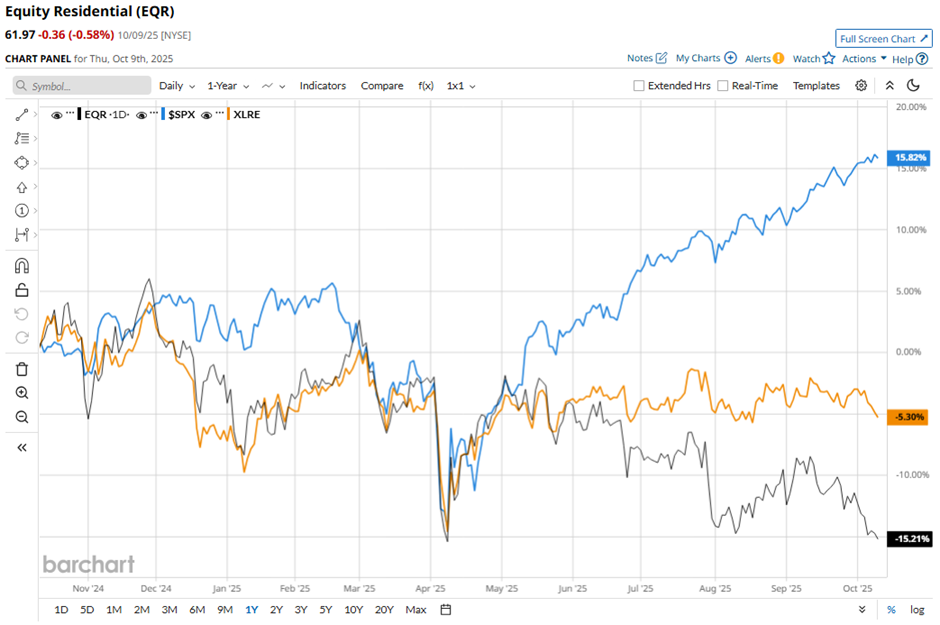

EQR stock has declined 14.7% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.3% gain and the Real Estate Select Sector SPDR Fund's (XLRE) 5.1% decrease over the same time frame.

Shares of Equity Residential rose 1.2% following its Q2 2025 results on Aug. 4 as the company reported normalized FFO per share of $0.99, matching estimates and up 2.1% year-over-year, supported by a 2.7% rise in same-store revenues and 20 bps higher occupancy at 96.6%. Investors reacted positively to the raised full-year 2025 normalized FFO guidance of $3.97 per share - $4.03 per share. Strong portfolio activity, including the $533.8 million acquisition of eight Atlanta properties and steady rental income growth of 4.7%, further boosted market sentiment. Analysts' consensus view on EQR stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 27 analysts covering the stock, 10 suggest a "Strong Buy," one gives a "Moderate Buy," and 16 recommend a "Hold." This configuration is slightly less bullish than three months ago, with 11 analysts suggesting a "Strong Buy." The average analyst price target for Equity Residential is $73.83, indicating a potential upside of 19.1% from the current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|