|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

Understanding Profit Probabilities - The Power of the Stock and Dual Option Selling Strategy

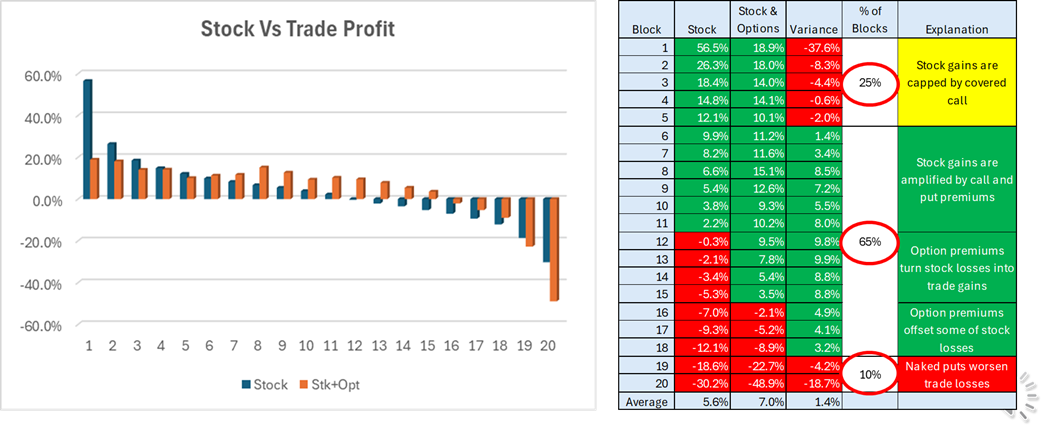

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 76% trade win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk. Overview  Breaking Down the Outcomes The data shows that the Bull Strangle strategy creates a more balanced and resilient performance profile compared to simply owning the stock. Specifically:

What the Numbers Tell Us When viewed together, these probabilities show why the Bull Strangle is effective:

This probability profile demonstrates the strategy’s edge: while covered calls sometimes cap stock gains, the trade-off is a significant improvement in consistency, reduced volatility in returns, and a greater likelihood of positive outcomes over time. Conclusion The Bull Strangle is not designed to maximize profits in runaway bull markets — it is built to grind out steady, risk-controlled returns across a wide range of market conditions. The historical data makes this clear: by systematically selling option premium, traders shift the odds in their favor, turning many losing scenarios into break-evens or winners. Over hundreds of trades, this consistency compounds, making the Bull Strangle a strategy that favors discipline, patience, and probability over speculation. More Information For a short video explaining the Bull Strangle strategy. For a more detail on the strategy To subscribe to the Bull Strangle Newsletter Contact Darren Carlat Managing Director Darren@SpreadEdgeCapital.com (214) 636-3133 Disclaimer This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|